Inswitch is a global embedded Fintech company that offers digital financial services through its omnichannel 360 Fintech-as-a-Service platform.

Inswitch has implemented over 100 platforms in over 30 countries from Latin America and the Caribbean, from Telcos and Retailers to banks and marketplaces. As the expectations for more significant improvement are still growing, they first wanted to ensure their AWS environment was architected most efficiently and securely to support this anticipated growth.

DinoCloud and AWS are helping Inswitch create a safer and more secure architecture to protect their data. As Inswitch belongs to the financial industry, the architecture needed to be PCI compliant. DinoCloud is a leading company in the creation, migration, and optimization of products deployed in the cloud.

Financial institutions are facing new challenges at present. Almost all of the data managed by these institutions is confidential and sensitive, and they need to comply with specific international standards to get validation and credibility. Cloud architectures are becoming a must, and Inswitch did not want to fall behind with this new requirement. Payment Card Industry Compliance (or PCI in short) is a standard that serves as a guideline for all those financial institutions that process, store and manage data from cardholders.

DinoCloud, a leading adoption of global innovation and cloud computing technologies company, has been working for five years, assisting and guiding different companies in the growth of their customers’ businesses to make them healthier and more competitive. Gonzalo Campos, Solutions Architect and Security Specialist for DinoCloud, stated the following: “At DinoCloud, we specialize in providing professional services focused on financial institutions. We understand the importance of security matters in these organizations, and our main focus is to provide solutions that meet the necessary compliance and to implement cutting-edge resource access management and APIs. We ensure data integrity, backup, and protection, centralizing and providing visibility of security metrics/findings at all levels by automating controls and remediation”.

In financial institutions, having a cloud-based and secure architecture for managing and processing sensitive data has become paramount. Amazon Web Services (AWS) provides a wide array of solutions to address these ever-increasing needs. “Many of the services are compliant to the highest international standards. And this, together with the native integration of computing services, storage and databases, and the specific security services, allows us to create secure environments according to our compliance requirements in an agile manner”, said Campos.

Inswitch is A cloud-based, finance-as-a-service platform that enables any company to offer financial services. This DinoCloud and AWS customer aims to make any company a fintech company by providing its customers with the tools, planning, and expertise needed to implement their digital financial services based on Inswitch’s APIs.

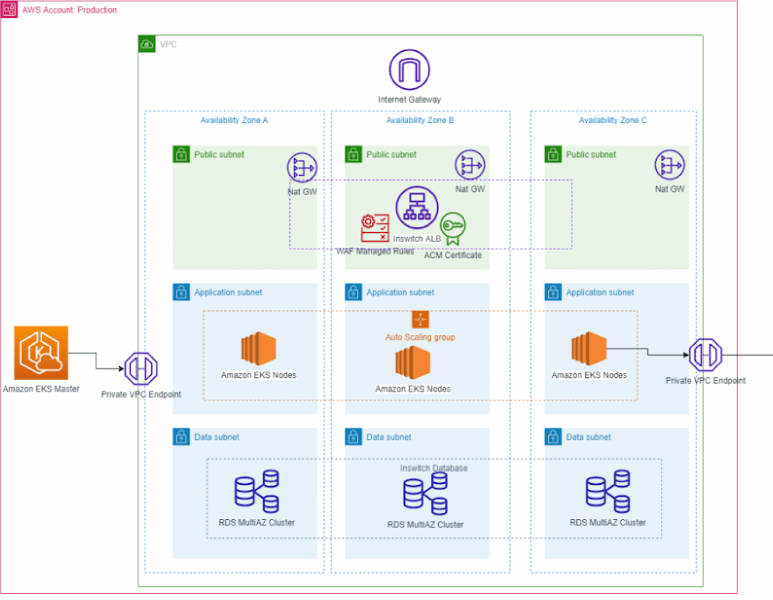

DinoCloud and Inswitch first met when the latter needed to review their AWS WAF rules. After a successful revision and modification, Inswitch saw the opportunity to migrate all their on-premise architecture to EKS, and that is the ongoing project that DinoCloud and Inswitch are currently working on together. Apart from strengthening the company’s cloud security after the migration, Inswitch now counts with a microservice architecture using Kubernetes as they needed to shift from public to private all their databases. Also, a governance layer was deployed for

the security of internal risks. Finally, Inswitch now has a dashboard brought by AWS OpenSearch and AWS Prometheus for assessing metrics and setting alarms.

(*) Required fields